For most of us, real estate is the like-kind property with which we deal on a regular basis. That appears to be unaffected by the current tax bill. Whether or not we lose the ability to exchange personal property, it seems that a refresher on 1031 exchanges is in order.

1031 Exchanges – the Basics

Under Section 1031 of the United States Internal Revenue Code (26 U.S.C. § 1031), a taxpayer may defer recognition of capital gains and related Federal income tax liability on the exchange of certain types of property. The properties exchanged must be held for productive use in a trade or business, or for investment. That means that your personal home does not qualify, neither does your vacation home (probably . . . see discussion here). Inventory is also off the list.

Property exchanged must also be like-kind in order to qualify. This means that the property must be of the same nature or character. In the case of real estate, this is an easy test. Real property is generally of like-kind with any other real property. You can exchange an office building in Denver for a ranch in Montana or a strip mall in Salida for a farm near Ft. Collins. It is important to note, though, that you must satisfy all requirements. Consequently, like-kind real estate in the form of inventory (i.e., lots held by a developer) does not qualify under Section 1031 because it is not held for a “productive use and a trade or business, or for investment.” (Similarly, a coal mine in Kentucky may also qualify but you can only exchange it for a house in New Orleans if it is an investment rental).

Timing and Process

The IRS allows both simultaneous and delayed exchanges. In my practice, simultaneous exchanges are relatively rare. In such cases, you need an unrelated buyer and seller who simply want to trade real estate. This happens in boundary line adjustment situations, for example, but it is unusual, at best, for two unrelated parties to be in a position to just swap their real estate – enter the delayed exchange.

In a delayed exchange, you may sell your property, deposit the sales proceeds with a Qualified Intermediary, and then use that money to purchase another piece of property within 180 days. There are strict rules to follow during this six-month window, including the obligation to identify your potential replacement properties within 45-days. You must also avoid thinking that you have “six months”, as I stated above for if you close your sale on the 181st day, your exchange will fail. If you jump through all of the appropriate hoops, you may reinvest all of your sales proceeds into the replacement property and will owe no tax on the sale.

Note that a 1031 exchange is also referred to as a tax deferred exchange, meaning that you are not avoiding tax, merely deferring it to the next sale (or the next or the next if you continue to roll your proceeds using Section 1031).

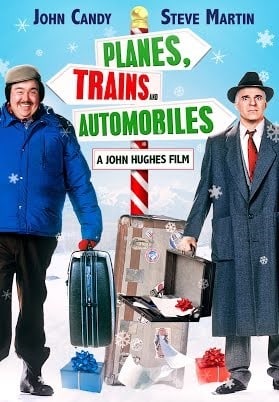

This discussion of exchanges is necessarily limited in nature. I avoided such topics as Reverse Exchanges, Safe Harbor, Improvement Exchanges, the 5-Day Rule, the 200% Rule, the 95% Rule, Drop and Swap Exchanges, to name a few. The message here is that tax deferred exchanges are elegant in their simplicity but complex in their implementation. If an exchange may be in your future, you should start planning early. You will need advice from your accountant and your lawyer and will most likely need to engage a reputable Qualified Intermediary. Regardless of the current uncertainty surrounding the changes to the Tax Code, a 1031 exchange can be a powerful tool in relation to your real estate holdings (or perhaps with your planes, trains and automobiles, too).